Many drivers choose to finance their car.

Financing is when you pay back a car's value in monthly instalments. This means you don't need to save up the car's entire cost before buying it. Instead, you factor your finance repayments into your monthly expenses.

This guide explains how car finance works. Once you're up to speed, check out a wide choice of nearly new and used cars for sale at Motorpoint, all with flexible finance options.

What does it mean to finance a car?

Like many expensive items, cars can be bought on finance. This is where the car's total cost is broken down into lots of smaller payments and spread monthly over a long period – usually between two and four years.

Financing a car means you get the car straight away and don't have to save up the whole cost in one go. In exchange, you'll usually pay additional interest on your car finance, which means the total cost will be higher than buying it outright with cash.

How does car finance work?

Here are the key parts of car finance:

- Finance type – there are two main types of car finance:

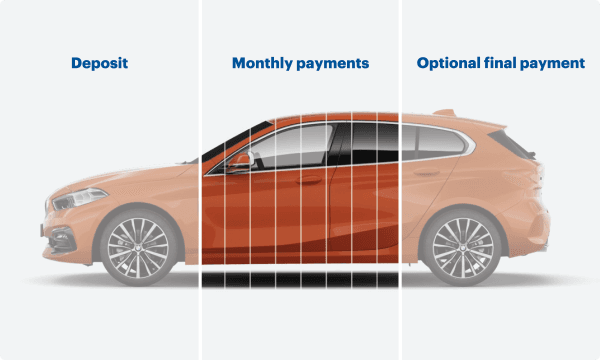

- PCP car finance – personal contract purchase (PCP) is where you borrow the amount of money a car's expected to lose in value during the agreement. This results in lower monthly payments than HP finance, but means you'll have to make a large optional final payment at the end of the agreement if you want to own it outright. This optional final payment will roughly be the car's remaining value. Learn more about PCP finance.

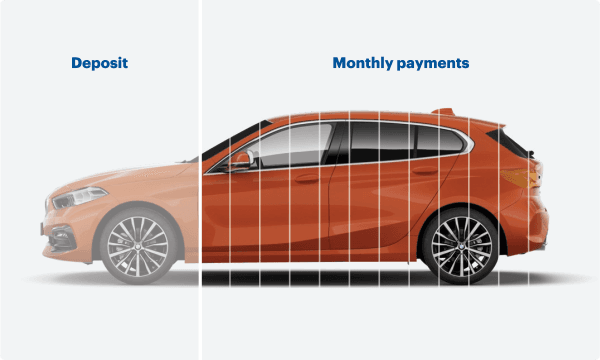

- HP car finance – hire purchase (HP) is simpler than PCP because you're just financing the car's whole value in one go. Once the agreement ends, you'll have paid back the car's whole value and will be its full legal owner with no optional final payment. HP monthly payments are higher than PCP finance as a result. Learn more about HP finance.

- Deposit – an upfront payment at the start of the finance agreement. This is usually a percentage of the car's value, for example a 10% deposit on a £20,000 car would be £2,000. The deposit helps lower the overall cost of finance, reducing your monthly repayments and the total interest you'll pay. If you're trading in an old car as part of the agreement, A deposit is usually optional and retailers like Motorpoint will offer no-deposit finance.

- Total amount of credit – credit is the total amount of money the finance company lends to you to pay for the car. This amount is worked out as the car's total cash value minus whatever deposit you paid at the start of the agreement. The total amount of credit will be split across your monthly payments, either in full for a HP finance agreement or in part for a PCP finance agreement.

- Monthly payment – the regular payment you'll make every month to pay off the credit you've borrowed from the finance lender. For most new and used cars, this figure will be somewhere between £200 and £600.

- Interest rate – a percentage figure that determines how much interest you'll pay on top of repaying the value of the car. Rates can vary widely depending on the car you're financing, but figures between 3% and 15% are common. APR is a similar percentage figure that includes the interest rate plus any additional fees.

- Total interest payable – the amount of money you'll pay in interest over the course of the finance agreement. This is the 'cost' of the finance that you'll pay in addition to the total cost of the car.

- Duration – how long the finance agreement lasts in total, measured in months. A shorter agreement will be over sooner but has higher monthly payments. A longer agreement takes more time to pay off, but the monthly payments will be lower. Longer agreements will usually see you pay a bit more interest in total.

- Optional final payment (PCP finance only) – PCP repayments broadly cover the amount of value a car's lost over the agreement. The car's remaining value in a PCP finance agreement becomes the optional final payment – also known as a 'balloon' payment. To fully own the car at the end of the agreement, you'll need to pay or refinance the optional final payment. Alternatively, you can trade the car in and put any equity towards another finance agreement, or simply hand the vehicle back and walk away with nothing more to pay.

- Mileage limit (PCP finance only) – your total amount of credit and optional final payment in a PCP agreement are influenced by how much the lender thinks the car will be worth at the end of the agreement. Since a car's mileage affects its value, lenders set mileage limits – commonly between 5,000 and 15,000 miles per year – to ensure the car's worth remains in line with their estimates.

Our car finance glossary explains all the common car finance terms.

How do you finance a car?

Here's a step-by-step guide to arranging car finance:

- Work out what your budget is – it's important that you can fully afford your car finance agreement before accepting it. You need to work out how much you can afford to pay per month based on your income and current expenses. Use helpful tools like our car finance calculator to get an estimate of how much your monthly finance payments could be. You'll also need to work out how much of a deposit you want to pay, and whether you're bringing in a car to part-exchange.

- Choose the car you'd like – once you know how much you can afford, find a car you like that's within budget and sold by a reputable car retailer. You will probably be able to apply for car finance directly through that retailer – this is what happens if you finance a car at Motorpoint – or you can apply for finance with a third-party lender if the retailer allows it.

- Apply for finance – either you or the car retailer contacts the finance lender with your application. This process includes a hard check on your credit history where the lender decides whether the agreement is affordable for you based on your income and expenses. The better your credit history, the better your chances of being offered the representative finance example rate.

- Get accepted for finance – if the lender decides that the agreement is affordable for you, they'll approve your application. At this point, you'll start paying your finance agreement and you're ready to…

- Drive away – this is the fun bit. With your finance agreement in place, you can hop into your new car and drive away. If you've taken out PCP finance, be mindful that you'll have limits on your annual mileage and will have to pay for any wear and tear if you hand the car back at the end of the agreement.

- Repay the finance agreement – this is the slightly less fun bit. You'll need to keep up with your monthly repayments for the length of your finance agreement. Failing to do so will negatively impact your credit history. Drivers with HP finance will fully own the car once they've paid off their finance agreement, while drivers with PCP finance can either pay the optional final payment, trade the car in for another one, or hand the car back and walk away. Read our guide on what to do at the end of your PCP finance agreement.

What’s the best way to finance a car?

That depends on your circumstances and priorities.

If you want the lowest monthly repayments, PCP finance might be the best option. This means you're only repaying the value the car loses over the duration of the agreement. You can then decide to refinance your optional final payment if you want to own the car, or you can trade it in and transfer any equity into a new finance agreement on a different car.

If you want the lowest total cost, HP finance might be a better choice. Your monthly payments will be higher than PCP finance, but you'll own the car at the end of the agreement and will have nothing more to pay from this point onwards. You also won't need to worry about mileage or wear-and-tear limits.

What do you need to finance a car?

Here's what you'll need to finance a car in the UK:

- Be at least 18 years old – drivers who pass when they're 17 will have to wait a year

- Proof of identification – you'll usually need more than one form of photo ID depending on the lender

- Proof of income and expenditure – usually bank statements, but self-employed people might need to present extra evidence

- Proof of address – you may need anywhere from three to five years' history depending on the lender

- Credit history – you'll need to submit to a hard credit check to get approved for car finance

Is it hard to get car finance?

In the UK, finance lenders are required by law to perform due diligence on every finance agreement. This is to make sure that you can afford the finance you're applying for, and minimise the risk that you default on your payments.

The application process itself is generally very easy – especially if you're working with a reputable car retailer like Motorpoint who handles the application for you. However, the lenders themselves have stringent checks in place to make sure you can afford the finance.

Assuming you've chosen an affordable finance agreement and your credit history is fairly clean, you should get accepted by most lenders. However, drivers with bad credit will find they're more likely to get turned down by lenders, or offered less-desirable interest rates that reflect their greater risk. Learn more about getting car finance with bad credit.

What checks are done for car finance?

Lenders are legally obliged to assess whether you're able to afford a potential finance agreement. They'll need to check your income and outgoings – usually via your bank statements – to make sure you're earning enough money to afford the repayments on top of everything you already pay for.

They'll also assess how much of a risk you present for non-payment. This means they'll perform a hard check on your credit history. Any previous missed payments, defaults or other credit mismanagement will probably see your finance application rejected, or you'll find you're offered a higher interest rate.

What are the benefits of car finance?

- You get the car straight away – no need to wait to save up for the car's whole value before you buy it

- Monthly repayments can be lower than a bank loan – if you take out PCP finance, you monthly payments will probably be much lower than if you'd taken out a bank loan to buy a car

- Easy to swap cars at the end of the agreement – if you like to have a new car every few years, PCP finance makes it easy to transfer any equity into another finance agreement for a new car once your current deal ends

What are the drawbacks of car finance?

- Higher total cost than buying the car outright – if you'd saved up the total cash price of the car, you could buy it outright without finance or any interest to pay

- You're locked in until the agreement is paid off – it's expensive to pull out of a car finance agreement. Most lenders will require you've paid at least 50% of the total agreement value before considering a cancellation. Even then, you'll probably have extra fines to pay for not completing the agreement

- Mileage and wear-and-tear limits apply to PCP – if you're taking out PCP finance, you'll have a set maximum annual mileage. Exceeding this figure will incur heavy fines at the end of the agreement, as will any substantial damage that needs repairs

Is financing a car a good idea?

For most drivers, financing a car is a good idea as long as they understand how the agreement works and they pick the type of finance that suits them best.

Saving up a lump sum for a car would take most people a long time and, while you're waiting, you don't have access to a car. However, financing lets you get out on the road straight away without needing all the money available in one go. It's also fairly straightforward to work out whether you can afford a finance payment based on how much you have in your monthly budget.

However, financing a car is a serious agreement so you need to be confident you can afford to pay it off. Failing to keep up with payments will significantly impact your credit history and your future ability to access loans, mortgages and other financial products.